Finding life insurance for people over 80 years old presents unique challenges, but it remains an important consideration for many families. While traditional life insurance becomes more difficult to obtain and more expensive at advanced ages, several specialized options exist specifically designed for older adults. This comprehensive guide explores the available policies, key considerations, and alternatives to help you or your loved one make an informed decision about end-of-life financial planning.

Why Life Insurance Still Matters After 80

Many people wonder if life insurance is worth pursuing after age 80. While needs change significantly in later years, several compelling reasons exist to consider coverage:

Need Help Finding the Right Coverage?

Our insurance specialists can help you navigate the options available for seniors over 80.

Or call us: (800) 555-1234

Types of Life Insurance Policies for People Over 80

Several specialized life insurance options exist for people over 80 years old. Each has distinct advantages and limitations to consider:

Final Expense Insurance

Also called burial insurance, this whole life policy is specifically designed to cover funeral costs and final expenses.

- Coverage amounts: $5,000-$25,000

- No expiration date (permanent coverage)

- Fixed premiums that never increase

- Cash value component that grows over time

Guaranteed Issue Life Insurance

This policy offers guaranteed acceptance regardless of health status, with no medical questions or exams.

- Coverage amounts: $2,000-$25,000

- Higher premiums than other options

- Typically has a 2-3 year graded death benefit

- Best for those with serious health conditions

Simplified Issue Life Insurance

This policy requires answering health questions but no medical exam, offering a middle ground between fully underwritten and guaranteed issue policies.

- Coverage amounts: $5,000-$50,000

- Lower premiums than guaranteed issue

- Quick approval process (often days)

- Some health conditions may disqualify you

“Many seniors over 80 don’t realize that specialized life insurance options exist specifically designed for their age group. These policies focus on providing peace of mind rather than large death benefits.”

Comparing Policy Options for Seniors Over 80

| Policy Type | Medical Exam | Health Questions | Coverage Range | Waiting Period | Best For |

| Final Expense | No | Yes (basic) | $5,000-$25,000 | 0-2 years | Relatively healthy seniors |

| Guaranteed Issue | No | No | $2,000-$25,000 | 2-3 years | Serious health conditions |

| Simplified Issue | No | Yes (detailed) | $5,000-$50,000 | 0-1 year | Minor health issues |

Understanding Premium Costs for People Over 80

Life insurance premiums for people over 80 years old are significantly higher than for younger individuals due to increased mortality risk. Here are the key factors that affect your premium costs:

Factors Affecting Premium Costs

Sample Monthly Premium Ranges

| Age | Gender | $10,000 Coverage | $20,000 Coverage |

| 80 | Female | $98-$120 | $194-$240 |

| 80 | Male | $140-$170 | $276-$340 |

| 85 | Female | $125-$160 | $250-$320 |

| 85 | Male | $180-$220 | $360-$440 |

Note: Premium rates vary significantly between insurance providers. The figures above represent average ranges based on industry data for relatively healthy individuals. Your actual rates may differ based on your specific circumstances and the insurance company’s underwriting guidelines.

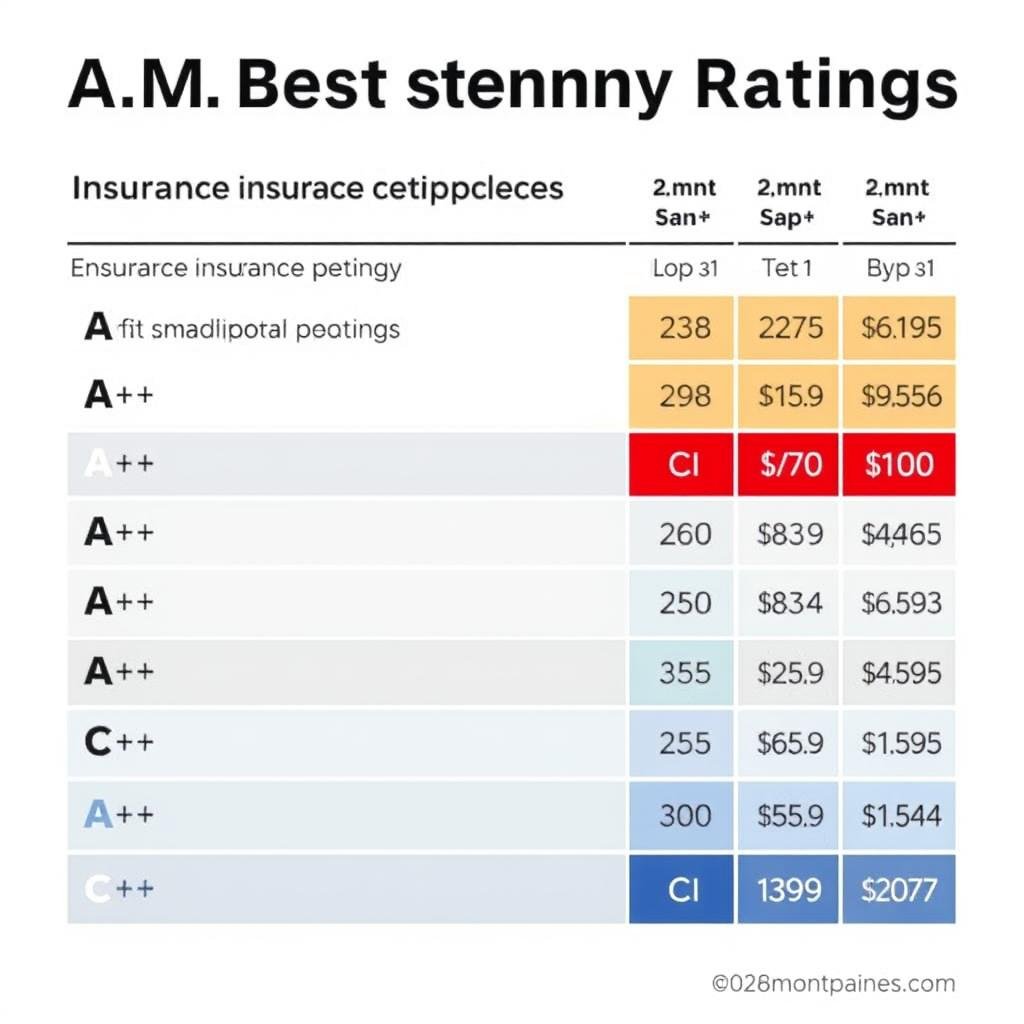

Best Life Insurance Companies for People Over 80

Based on our research of policies available to seniors over 80, these companies consistently offer competitive rates, solid financial stability, and policies designed specifically for older adults:

Mutual of Omaha

Offers both simplified issue and guaranteed issue policies with coverage up to $40,000 for applicants up to age 85.

- A+ A.M. Best financial rating

- Living Promise policy available up to age 85

- Quick approval process

AARP/New York Life

Offers guaranteed acceptance whole life insurance for AARP members up to age 85 with coverage up to $25,000.

- A++ A.M. Best financial rating

- No health questions or medical exam

- Must be an AARP member

Colonial Penn

Known for their guaranteed acceptance policies with coverage available up to age 85 and their “unit” based pricing structure.

- A- A.M. Best financial rating

- No health questions or medical exam

- Fixed premium rates by age group

Compare Multiple Providers at Once

Get personalized quotes from top-rated insurance companies that offer coverage for people over 80 years old.

Key Considerations When Choosing Life Insurance Over 80

When evaluating life insurance options for someone over 80 years old, several important factors should influence your decision:

Waiting Periods

Most guaranteed issue policies have a 2-3 year waiting period during which only premiums paid plus interest are returned if death occurs (except for accidents). Simplified issue policies may have shorter or no waiting periods depending on health.

Beneficiary Considerations

Choose beneficiaries carefully and consider naming a contingent beneficiary. Some policies allow the death benefit to be paid directly to a funeral home, which can simplify arrangements for your family.

Company Financial Strength

Check the financial stability ratings (A.M. Best, Moody’s, etc.) of any insurance company you’re considering. Higher-rated companies offer more security that they’ll be able to pay claims when needed.

Advantages of Getting Life Insurance Over 80

- Provides funds for funeral and burial expenses

- Helps cover outstanding medical bills or debts

- Leaves a small legacy for loved ones

- Gives peace of mind to you and your family

- No medical exam options available for most policies

Limitations to Consider

- Higher premiums than policies for younger people

- Limited coverage amounts (typically $2,000-$50,000)

- Waiting periods on many guaranteed issue policies

- May not be cost-effective if you have significant savings

- Some health conditions may disqualify you from better rates

Alternatives to Traditional Life Insurance for Seniors Over 80

Traditional life insurance isn’t the only option for covering end-of-life expenses. Consider these alternatives that might better suit your situation:

Pre-paid Funeral Plans

Arrange and pay for funeral services in advance directly with a funeral home.

Average cost: $10,000-$15,000 depending on services selected

Funeral Trusts

A specialized trust account specifically designated to cover funeral expenses.

Typical funding amount: $8,000-$15,000 for comprehensive coverage

Dedicated Savings Account

Set aside funds in a dedicated savings account specifically for final expenses.

Recommended amount: $10,000-$15,000 for comprehensive coverage

Important consideration: If Medicaid eligibility is a concern, consult with an elder law attorney before choosing an alternative to life insurance. Some options like irrevocable funeral trusts may be exempt from Medicaid asset calculations, while others could affect eligibility.

Tips for Choosing the Right Life Insurance Over 80

Follow these practical steps to find the most suitable life insurance policy for someone over 80 years old:

Watch out for scams: Unfortunately, seniors are often targeted by insurance scams. Be wary of unsolicited offers, high-pressure sales tactics, or requests for payment before receiving policy documents. Always verify the insurance company’s legitimacy through your state’s insurance department.

Need Help Finding the Right Policy?

Our specialists can help you compare options from multiple providers to find the best coverage for your situation.

Or call: (800) 555-1234

Frequently Asked Questions About Life Insurance Over 80

Can I get life insurance at 80 with no medical exam?

Yes, both guaranteed issue and simplified issue life insurance policies are available for people over 80 without requiring a medical exam. Guaranteed issue policies have no health questions at all, while simplified issue policies ask basic health questions but don’t require physical examinations.

What is the maximum age for life insurance eligibility?

Most insurance companies offer guaranteed issue policies up to age 85, though a few select providers may extend coverage to age 90. After age 85, options become extremely limited and significantly more expensive.

What is a graded death benefit?

A graded death benefit is a policy provision that limits the payout if death occurs within the first 2-3 years of coverage (except for accidental death). During this period, beneficiaries typically receive only the premiums paid plus interest, rather than the full face value. After the graded period ends, the full death benefit becomes payable.

How much coverage can I get if I’m over 80?

Most policies for people over 80 offer coverage amounts between $2,000 and $50,000, with $10,000-$25,000 being the most common range. The exact maximum depends on the insurance company, policy type, and sometimes your health status.

Is life insurance worth it at age 85?

Whether life insurance is worth it at age 85 depends on your specific financial situation and goals. If you don’t have savings set aside for funeral expenses and don’t want to burden family members with these costs, a small policy may be worthwhile despite the higher premiums. However, if you have adequate savings or have made other arrangements, life insurance may not be necessary.

Can I buy life insurance for my elderly parent?

Yes, you can purchase life insurance for an elderly parent if you have their consent and can demonstrate “insurable interest” (showing you would face financial hardship upon their death). You’ll need your parent’s participation in the application process, including their signature. Some companies may also require the parent to be the policy owner, with you as the premium payer and beneficiary.

Making the Right Decision for Your Family’s Peace of Mind

Finding appropriate life insurance for people over 80 years old requires careful consideration of your specific needs, budget, and health situation. While premiums are higher and coverage amounts more limited than policies for younger individuals, the right policy can provide valuable peace of mind and financial protection for your loved ones.

Whether you choose a final expense policy, guaranteed issue coverage, or an alternative like a funeral trust, the most important thing is making an informed decision that aligns with your overall financial plan. By understanding the options available and comparing multiple providers, you can find a solution that provides the protection you need at a price you can afford.

Ready to Secure Your Family’s Future?

Get personalized quotes from top-rated insurance companies that specialize in coverage for seniors over 80.

Prefer to talk to a specialist? Call (800) 555-1234