Your 30s mark a decade of significant life changes—career advancement, home purchases, growing families, and increasing financial responsibilities. While life insurance might not be the most exciting topic, it’s the foundation of financial security for those who depend on you. Think of it as a safety net that ensures your loved ones can maintain their lifestyle and achieve their dreams, even if you’re no longer there to provide.

In this guide, we’ll explore why adults aged 30-39 should prioritize life insurance, compare policy types, and provide actionable steps to secure the right coverage for your unique situation. The good news? Your 30s are actually the sweet spot for life insurance—you’re young enough to lock in affordable rates but established enough to know what you’re protecting.

Why Life Insurance Matters in Your 30s

Securing life insurance in your 30s provides essential protection for your growing family

Your 30s are typically filled with major life milestones that create new financial responsibilities. Here’s why securing life insurance during this decade is particularly important:

Mortgage Protection

The average first-time homebuyer is 33 years old. Without your income, your partner might struggle to maintain mortgage payments, potentially forcing a home sale during an already difficult time.

Growing Families

Many adults have children in their 30s. Life insurance ensures your children’s future expenses—from daily needs to college education—are covered if something happens to you.

Debt Management

From student loans to car payments, the average 30-something carries significant debt. Life insurance prevents transferring this burden to loved ones.

Real-Life Scenario: The Martins’ Story

“We purchased our first home at 32 and had our daughter the same year. A $750,000 term life policy costs us just $31 monthly—less than our streaming subscriptions—but ensures our daughter can stay in her home and attend college even if we’re not here.”

Protect What Matters Most

Get personalized life insurance quotes tailored to your specific situation.

Term vs. Whole Life Insurance: Which Is Right for You?

For adults in their 30s, choosing between term and whole life insurance involves balancing immediate affordability with long-term benefits. Let’s compare these options to help you make an informed decision:

| Feature | Term Life Insurance | Whole Life Insurance |

| Monthly Premium (30-year-old, $500K coverage) | $25-$35 | $300-$400 |

| Duration | Fixed period (10, 20, or 30 years) | Lifetime coverage |

| Cash Value | None | Builds over time, can be borrowed against |

| Premium Changes | Fixed during term, increases at renewal | Fixed for life |

| Best For | Maximum coverage at lowest cost during key years | Lifetime protection and wealth building |

Which Option Makes Sense in Your 30s?

Term Life Advantages

- Significantly more affordable

- Can secure large coverage amounts

- Covers your highest-risk financial years

- Many policies offer conversion options later

Term Life Limitations

- Coverage expires after term period

- No cash value or investment component

- Renewal rates increase dramatically with age

- May need to requalify based on health

For most people in their 30s, term life insurance provides the ideal balance of affordability and protection. A 20 or 30-year term policy can cover your family through their most financially vulnerable years—while children are growing and major debts like mortgages are being paid down.

Pro Tip: Consider a “ladder strategy” by purchasing multiple term policies of different lengths. For example, a $1M policy might be structured as: $500K for 30 years + $300K for 20 years + $200K for 10 years. This approach provides maximum coverage when you need it most while reducing premiums as your financial obligations decrease.

Factors Affecting Your Coverage Needs and Premiums

Several key factors influence both how much life insurance you need and what you’ll pay for coverage in your 30s:

Health Status

Your current health significantly impacts your premiums. In your 30s, you’re likely still enjoying good health, which means favorable rates. However, conditions like high blood pressure, elevated cholesterol, or diabetes can increase your costs. Some companies offer better rates for specific conditions, so shopping around is essential.

Income Level

Your income directly affects how much coverage your family would need to maintain their lifestyle. A common recommendation is securing 10-15 times your annual income, though this varies based on your specific situation.

Number of Dependents

Each dependent increases your coverage needs. Consider not just current expenses but future ones like college education. For example, a 35-year-old with three young children might need significantly more coverage than a 38-year-old with one teenager.

Mortgage and Debt

Outstanding mortgage balances and other significant debts should be factored into your coverage amount. Many experts recommend having enough coverage to at least pay off your mortgage, allowing your family to remain in their home.

Did You Know? Life insurance rates typically increase 8-10% for every year you age. Securing coverage in your early 30s versus late 30s can save you thousands over the life of your policy.

Lock in Your Lowest Possible Rate

Rates increase with age. Secure your coverage while you’re young and healthy.

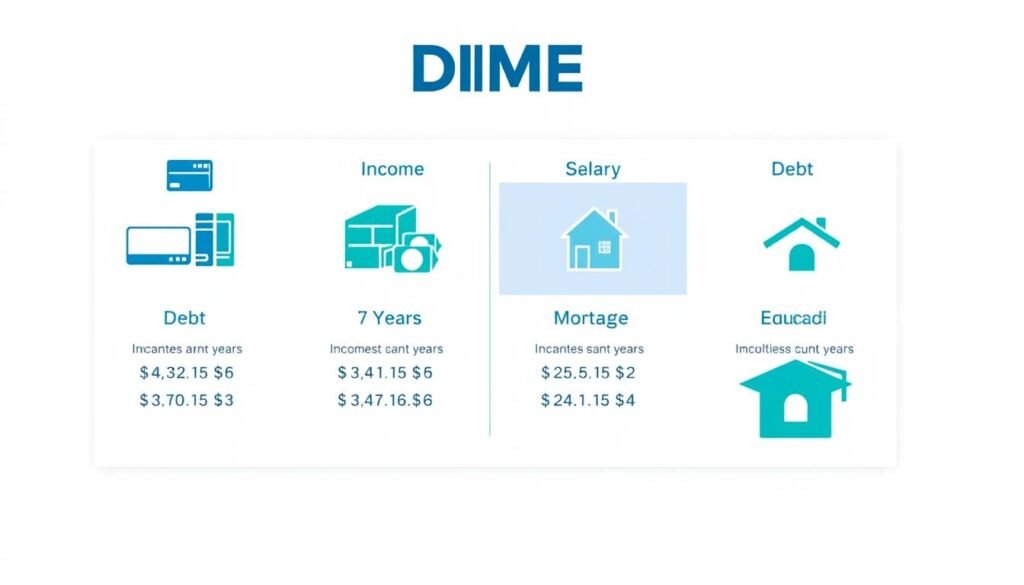

How to Calculate Your Life Insurance Needs: The DIME Method

Determining exactly how much life insurance you need can feel overwhelming. The DIME method provides a straightforward framework to calculate your coverage requirements:

D: Debt & Final Expenses

Add all outstanding debts (excluding mortgage) plus estimated funeral costs ($10,000-$15,000).

Example: $25,000 (credit cards, auto loans) + $15,000 (funeral) = $40,000

I: Income Replacement

Annual income × number of years your family needs support (typically 10-20 years).

Example: $80,000 × 15 years = $1,200,000

M: Mortgage Balance

The remaining balance on your mortgage or other housing expenses.

Example: $350,000 remaining mortgage balance

E: Education Costs

Estimated college expenses for each child (approximately $100,000-$200,000 per child for a 4-year degree).

Example: 2 children × $150,000 = $300,000

DIME Calculation Example: $40,000 (Debt) + $1,200,000 (Income) + $350,000 (Mortgage) + $300,000 (Education) = $1,890,000 total coverage needed

Real-Life Scenario: The Career Climber

“As a 34-year-old marketing executive, I initially thought $500K would be enough coverage. After using the DIME method, I realized I needed $1.5M to truly protect my family’s future. The difference in premium was only $18 more per month—a small price for complete peace of mind.”

Remember that your insurance needs will change over time. Many experts recommend reviewing your coverage every 3-5 years or after major life events like having another child, purchasing a larger home, or significant income changes.

Balancing Affordability with Adequate Coverage

Finding the sweet spot between sufficient protection and manageable premiums is crucial. Here are practical strategies to maximize your coverage while keeping costs in check:

Improve Your Health Rating

- Quit smoking (can reduce premiums by 50%)

- Maintain healthy weight (BMI between 18.5-24.9)

- Control chronic conditions before applying

- Schedule medical exam in the morning for best results

Policy Structure Strategies

- Consider the “ladder” approach with multiple policies

- Look for convertible term policies for future flexibility

- Ask about rate bands (premiums often decrease at certain coverage thresholds)

- Pay annually instead of monthly (can save 2-8%)

Shopping Smart

- Compare at least 5-7 companies (rates can vary by 50%)

- Work with an independent broker who represents multiple carriers

- Ask about professional or alumni discounts

- Bundle with other insurance when beneficial

Real-Life Scenario: The Single-Income Household

“As a stay-at-home dad with a spouse who’s the primary earner, we initially only looked at coverage for my wife. We realized I needed coverage too—not just for childcare costs if something happened to me, but also to provide options if my wife needed to reduce work hours. We found an affordable term policy that gives us complete protection.”

Warning: Don’t sacrifice adequate coverage just to save on premiums. Being underinsured defeats the purpose of having life insurance. It’s better to have the right coverage with a slightly higher premium than insufficient coverage that won’t protect your family properly.

Find Your Perfect Balance

Get personalized recommendations that maximize protection while respecting your budget.

Common Life Insurance Mistakes to Avoid in Your 30s

Even the most diligent adults in their 30s can make these common life insurance missteps. Being aware of them can help you secure better protection for your loved ones:

1. Underinsuring Yourself

Many people in their 30s significantly underestimate how much coverage they need, often by hundreds of thousands of dollars. Remember that your policy should cover not just immediate expenses but long-term needs like income replacement and future education costs.

2. Delaying Purchase

Every year you wait to buy life insurance in your 30s, premiums increase by approximately 8-10%. Waiting just five years can cost you thousands over the life of your policy. Additionally, unexpected health issues can develop, potentially making you uninsurable or significantly increasing your rates.

3. Choosing Based Solely on Price

While affordability matters, the cheapest policy isn’t always the best value. Look beyond the premium to examine the company’s financial strength, policy features, conversion options, and customer service reputation.

4. Overlooking Riders and Additional Benefits

Many valuable policy enhancements are relatively inexpensive when added in your 30s. Consider riders like:

- Disability income rider: Provides income if you become disabled

- Critical illness rider: Pays a lump sum if diagnosed with specified serious illnesses

- Waiver of premium: Waives premiums if you become disabled

- Guaranteed insurability: Allows you to increase coverage without medical exams at specific life events

5. Not Reviewing Beneficiaries Regularly

Life changes quickly in your 30s. Ensure your policy beneficiaries reflect your current wishes, especially after marriage, divorce, or having children. Review your policy and beneficiaries at least every 3 years.

Frequently Asked Questions About Life Insurance for 30-39 Year Olds

Is 35 too late to get term life insurance?

Absolutely not. While premiums are lower the younger you are, 35 is still considered a prime age for purchasing life insurance. You’ll still qualify for excellent rates, especially if you’re in good health. The most important thing is to secure coverage now rather than waiting longer, as rates increase approximately 8-10% each year you age.

Can I adjust my coverage later if my needs change?

Yes, most policies offer flexibility. You can often increase coverage (subject to medical qualification) or purchase additional policies as your needs grow. Some term policies include a guaranteed insurability rider that allows increases at specific life events without medical underwriting. You can also typically reduce coverage if needed. The key is selecting a policy with good conversion and adjustment options.

How does my health affect my life insurance rates in my 30s?

Your health is one of the most significant factors affecting your premiums. In your 30s, minor health issues may have minimal impact, but conditions like diabetes, heart issues, or cancer history can substantially increase rates. The good news is that many insurers have become more accommodating of controlled conditions like mild anxiety, well-managed high blood pressure, or slightly elevated cholesterol. Being transparent about your health and shopping multiple carriers is essential.

Should I get life insurance if I’m single with no children?

Even without dependents, life insurance can be valuable in your 30s. It can cover funeral expenses, pay off debts that might otherwise burden parents or siblings, and lock in low rates while you’re young and healthy. If you plan to have a family in the future, securing coverage now can save you significantly. Additionally, some policies build cash value that can be accessed during your lifetime.

Is employer-provided life insurance enough?

Employer-provided coverage is rarely sufficient for adults in their 30s with financial obligations. These policies typically offer only 1-2 times your annual salary, while experts recommend 10-15 times your income. Additionally, employer coverage usually terminates when you leave the company, potentially leaving you unprotected precisely when you’re between jobs and most vulnerable. Consider employer coverage a supplement to, not a replacement for, an individual policy.

Secure Your Family’s Future Today

Your 30s represent the ideal time to secure life insurance protection. You’re young enough to qualify for excellent rates but established enough to understand what you’re protecting. By taking action now, you’re not just purchasing a policy—you’re creating a foundation of financial security for those who matter most.

Remember that life insurance isn’t really about you—it’s about the people you love and the future you want to ensure for them, regardless of what tomorrow brings. It’s one of the most selfless financial decisions you can make.

The process of finding the right coverage doesn’t have to be complicated. By understanding your needs, comparing options, and working with experienced professionals, you can secure the perfect policy for your situation.

Take the First Step Today

Compare personalized quotes from top-rated insurance providers and find your perfect coverage.

or

to speak with a licensed insurance advisor