Entering your 50s brings significant life changes that impact your financial planning needs. While you may be focusing on retirement and paying off your mortgage, securing the right life insurance for people 50-59 years old remains a crucial part of protecting your family’s future. At this stage of life, your insurance requirements differ from those in your 30s or 40s, but the importance of coverage hasn’t diminished.

This comprehensive guide explores the various life insurance options available to people in their 50s, helping you navigate premium costs, policy types, and key considerations to find affordable coverage that provides peace of mind. Whether you’re looking to replace an existing policy or purchase life insurance for the first time, we’ll help you make an informed decision that balances protection and value.

Why Life Insurance Matters for People Aged 50-59

Many people mistakenly believe that life insurance becomes less important as they age, especially if their children are grown and financially independent. However, there are several compelling reasons why life insurance for people 50-59 years old remains a vital financial tool:

Financial Protection

Even in your 50s, you likely have significant financial responsibilities. Your spouse may depend on your income, or you might still be supporting adult children or aging parents. Life insurance ensures these loved ones won’t face financial hardship if something happens to you.

Mortgage and Debt Coverage

If you’re still paying off your mortgage or carrying other substantial debts, life insurance can prevent these financial burdens from falling to your family. A well-sized policy can cover outstanding loans and provide a clean financial slate for your beneficiaries.

Final Expense Coverage

Funeral costs and end-of-life expenses can easily exceed $10,000. Having life insurance means your family won’t need to worry about these costs during an already difficult time.

Legacy Planning

Many people in their 50s are thinking about the legacy they’ll leave behind. Life insurance provides a tax-efficient way to leave money to your loved ones or favorite charitable organizations.

Types of Life Insurance Policies for People Aged 50-59

When shopping for life insurance in your 50s, you’ll encounter several policy types, each with distinct advantages and limitations. Understanding these options is crucial to finding the right coverage for your specific needs.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 15, 20, or 30 years. It’s generally the most affordable type of life insurance policy, making it attractive for people in their 50s who want substantial coverage at reasonable rates.

Advantages of Term Life

- Lower premiums compared to permanent insurance

- Simple to understand with straightforward benefits

- Available in various term lengths to match specific needs

- Higher coverage amounts available at affordable rates

- Some policies can be converted to permanent coverage later

Limitations of Term Life

- Coverage expires at the end of the term

- Premiums increase significantly when renewing after age 60

- No cash value or investment component

- Longer terms (25-30 years) may be unavailable after age 55

- May require medical exams for best rates

Whole Life Insurance

Whole life insurance provides permanent coverage that lasts your entire lifetime, as long as premiums are paid. It also includes a cash value component that grows over time on a tax-deferred basis.

Advantages of Whole Life

- Lifetime coverage that never expires

- Fixed premiums that never increase

- Builds cash value you can borrow against

- Potential dividend payments with participating policies

- Estate planning benefits and tax advantages

Limitations of Whole Life

- Significantly higher premiums than term insurance

- Lower death benefits for the same premium amount

- Cash value grows slowly in early years

- Less flexible than universal life insurance

- May require medical underwriting

Guaranteed Issue Life Insurance

Guaranteed issue whole life insurance is designed specifically for people who may have health concerns that make qualifying for traditional policies difficult. As the name suggests, approval is guaranteed regardless of your health status.

Advantages of Guaranteed Issue

- No medical exam or health questions required

- Approval guaranteed regardless of health status

- Fixed premiums that never increase

- Permanent coverage that builds cash value

- Quick and easy application process

Limitations of Guaranteed Issue

- Higher premiums for relatively low coverage amounts

- Typically limited to $25,000-$50,000 in coverage

- Graded death benefit (reduced payout in first 2-3 years)

- Not ideal if you’re in good health and qualify for other options

- Limited rider options compared to traditional policies

Find the Right Policy for Your Needs

Compare personalized quotes from top-rated insurance companies to find affordable coverage that protects your loved ones.

Cost Factors for Life Insurance at Ages 50-59

The cost of life insurance for people 50-59 years old varies significantly based on several key factors. Understanding these variables can help you find the most affordable options for your situation.

Age and Gender Impact

Age is one of the most significant factors affecting your premium rates. Life insurance costs increase with each year, with noticeable jumps as you move through your 50s. Women typically pay 20-30% less than men of the same age due to longer average lifespans.

| Age | Male (Non-Smoker) $500K/20yr Term | Female (Non-Smoker) $500K/20yr Term |

| 50 | $124/month | $86/month |

| 52 | $163/month | $110/month |

| 55 | $223/month | $155/month |

| 57 | $290/month | $202/month |

| 59 | $358/month | $251/month |

Health and Lifestyle Factors

Your health status significantly impacts your life insurance rates. Insurers typically classify applicants into categories like Preferred Plus, Preferred, Standard, and Substandard based on your medical history and current health.

Health Conditions That Affect Rates

- High blood pressure or cholesterol

- Diabetes or pre-diabetes

- Heart conditions

- Cancer history

- Respiratory issues

Lifestyle Factors That Affect Rates

- Tobacco use (increases rates by 2-3 times)

- Alcohol consumption

- Dangerous hobbies or occupations

- Driving record

- Family medical history

Coverage Amount and Term Length

The amount of coverage you choose and the length of your term policy directly impact your premiums. Higher coverage amounts and longer terms result in higher monthly costs. For people in their 50s, 10-15 year terms are often more affordable than 20-30 year options.

Policy Type Comparison

Different policy types come with vastly different premium structures. Term life insurance is typically the most affordable option, while permanent policies like whole life insurance cost significantly more but offer lifetime coverage and additional benefits.

| Policy Type | Average Monthly Premium (55-year-old male, $250K) | Key Features |

| Term (20-year) | $127 | Temporary coverage, expires after term |

| Whole Life | $462 | Permanent coverage, builds cash value |

| Universal Life | $406 | Permanent coverage, flexible premiums |

| Guaranteed Issue | $175-$250 | No medical exam, limited coverage amount |

Need personalized advice on finding affordable coverage?

Top Considerations When Buying Life Insurance at Ages 50-59

When shopping for life insurance for people 50-59 years old, several key factors should guide your decision-making process. These considerations will help you find the right balance between affordability and adequate protection.

Pre-existing Health Conditions

By your 50s, many people have developed health conditions that can affect life insurance eligibility and rates. However, having a pre-existing condition doesn’t mean you can’t get coverage. Different insurance companies have varying underwriting guidelines for specific health issues.

Important: If you have conditions like diabetes, high blood pressure, or heart disease, work with an independent agent who can match you with insurers that specialize in covering your specific health profile. Some companies are more lenient with certain conditions than others.

Policy Term Length

When choosing a term life insurance policy, consider how long you need coverage. Many people in their 50s find that a 10-15 year term aligns well with their remaining working years and financial obligations. Shorter terms also come with more affordable premiums.

When to Choose Shorter Terms (10-15 years)

- Your mortgage will be paid off within that timeframe

- You plan to retire in 10-15 years

- Your children will be financially independent soon

- You’re primarily concerned about covering specific debts

When to Choose Longer Terms (20+ years)

- You have younger children or dependents

- You have a longer mortgage term remaining

- You’re supporting a spouse who doesn’t work

- You want to leave a legacy regardless of when you pass

Conversion Options

Many term life insurance policies offer conversion privileges that allow you to convert to permanent coverage without a new medical exam. This feature becomes increasingly valuable as you age and your health potentially changes.

Look for term policies with generous conversion periods that extend to age 65 or beyond. This gives you flexibility if your health deteriorates but you still need coverage after your term expires.

Riders and Additional Benefits

Policy riders can enhance your coverage by adding valuable benefits. However, not all riders provide equal value, especially for people in their 50s. Consider these potentially useful riders:

Accelerated Death Benefit

Allows you to access a portion of your death benefit if diagnosed with a terminal illness, helping cover medical expenses and end-of-life care.

Long-Term Care Rider

Provides benefits if you require long-term care services, which becomes increasingly important as you age.

Waiver of Premium

Waives your premiums if you become disabled and unable to work, ensuring your coverage remains in force.

Find Affordable Coverage That Fits Your Needs

Compare personalized quotes from top insurers specializing in coverage for people aged 50-59.

Tips for Buying Life Insurance in Your 50s

Finding the right life insurance policy at ages 50-59 requires a strategic approach. Follow these practical tips to secure the best coverage at the most competitive rates.

Compare Multiple Quotes

Insurance companies use different underwriting guidelines and pricing models, resulting in significant premium variations for the same coverage. Always compare quotes from at least 3-5 different insurers to find the best rates.

“The difference between the highest and lowest quotes for the same coverage can be as much as 40-60% for applicants in their 50s, especially those with minor health issues.”

Consider a Medical Exam

While no-exam policies offer convenience, they typically come with higher premiums. If you’re in relatively good health, taking a medical exam can result in significantly lower rates. The savings over the life of the policy often outweigh the temporary inconvenience.

No-Exam Policy Advantages

- Quick approval (often within days)

- No blood draws or medical tests

- Convenient application process

- Good option if you have health concerns

Medical Exam Policy Advantages

- Lower premiums (often 15-30% less)

- Higher coverage amounts available

- More policy options and riders

- Better value if you’re in good health

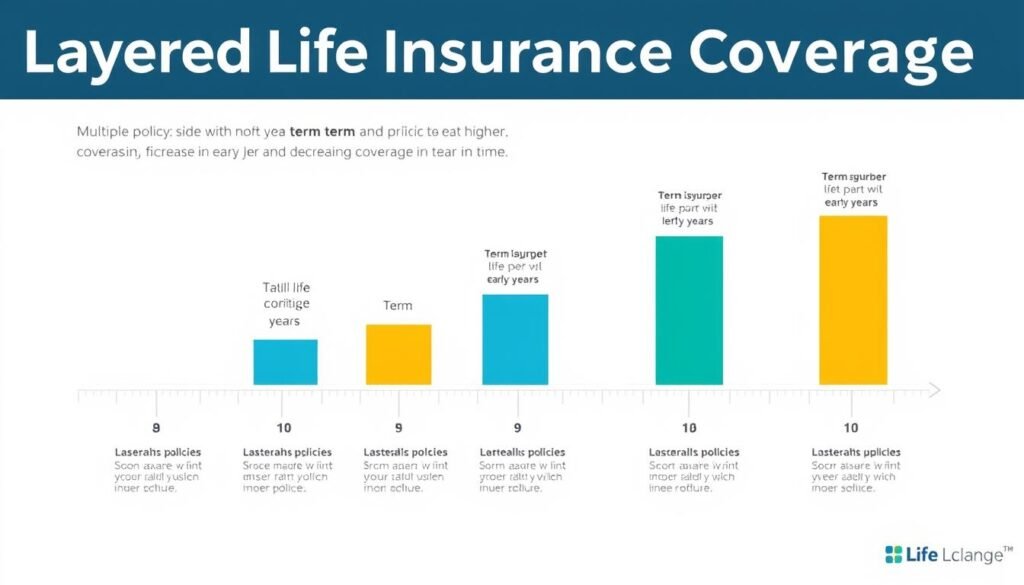

Layer Your Coverage

Instead of purchasing a single large policy, consider a strategy called “laddering” or “layering” where you buy multiple smaller policies with different term lengths. This approach can provide higher initial coverage when you need it most while reducing premiums as your needs decrease.

Example: Instead of one $500,000/20-year policy, consider a $200,000/10-year policy, a $200,000/15-year policy, and a $100,000/20-year policy. This provides $500,000 in coverage initially, decreasing as your needs reduce, while saving on overall premiums.

Work with an Independent Agent

Independent insurance agents represent multiple companies and can help navigate the complexities of finding affordable life insurance for people 50-59 years old. They understand which insurers are more lenient with specific health conditions and can guide you to the best options for your situation.

An independent agent can save you time and money by matching your specific health profile with insurers most likely to offer favorable rates. This is especially valuable if you have any health concerns.

Review and Update Beneficiaries

When purchasing a new policy or reviewing existing coverage, ensure your beneficiary designations are current and reflect your wishes. Life changes such as marriage, divorce, births, or deaths may necessitate updates to your beneficiaries.

Need help finding the best coverage options?

Frequently Asked Questions About Life Insurance for People 50-59 Years Old

Get answers to common questions about securing life insurance coverage in your 50s.

Can I get life insurance at 55 without a medical exam?

Yes, several insurance companies offer no-exam policies for people in their 50s. These include simplified issue policies that require answering health questions but no physical exam, and guaranteed issue policies that provide coverage regardless of health status. Keep in mind that no-exam policies typically offer lower coverage amounts (usually ,000-,000 for guaranteed issue and up to 0,000 for simplified issue) and come with higher premiums compared to fully underwritten policies.

Is term life insurance worth it after 50?

Term life insurance can be very worthwhile after 50, especially if you have specific financial obligations with a clear end date, such as a mortgage, children’s education expenses, or other debts. Term policies offer the highest coverage amount for the lowest premium, making them an efficient way to protect your family during your remaining working years. A 10-15 year term policy can provide crucial protection during the years when your financial obligations are highest, while still being affordable for most budgets.

How much does life insurance cost for a 59-year-old?

For a 59-year-old male in good health, a 0,000 20-year term life insurance policy costs approximately 8 per month. The same coverage for a female would cost around 1 monthly. Whole life insurance would be significantly more expensive, with premiums around

Frequently Asked Questions About Life Insurance for People 50-59 Years Old

Get answers to common questions about securing life insurance coverage in your 50s.

Can I get life insurance at 55 without a medical exam?

Yes, several insurance companies offer no-exam policies for people in their 50s. These include simplified issue policies that require answering health questions but no physical exam, and guaranteed issue policies that provide coverage regardless of health status. Keep in mind that no-exam policies typically offer lower coverage amounts (usually $25,000-$50,000 for guaranteed issue and up to $500,000 for simplified issue) and come with higher premiums compared to fully underwritten policies.

Is term life insurance worth it after 50?

Term life insurance can be very worthwhile after 50, especially if you have specific financial obligations with a clear end date, such as a mortgage, children’s education expenses, or other debts. Term policies offer the highest coverage amount for the lowest premium, making them an efficient way to protect your family during your remaining working years. A 10-15 year term policy can provide crucial protection during the years when your financial obligations are highest, while still being affordable for most budgets.

How much does life insurance cost for a 59-year-old?

For a 59-year-old male in good health, a $500,000 20-year term life insurance policy costs approximately $358 per month. The same coverage for a female would cost around $251 monthly. Whole life insurance would be significantly more expensive, with premiums around $1,000-1,500 monthly for the same coverage amount. Factors like your health, smoking status, and the specific insurance company can cause these rates to vary considerably. Shorter term lengths (10-15 years) would reduce these premiums substantially.

What health conditions make it difficult to get life insurance in your 50s?

While many health conditions can be accommodated with higher premiums, some make obtaining traditional coverage more challenging. These include recent cancer diagnoses, severe heart conditions, uncontrolled diabetes with complications, chronic kidney disease, and neurological conditions like Parkinson’s disease. However, even with these conditions, options like guaranteed issue policies are available, though with limited coverage amounts. Working with an independent agent who specializes in high-risk cases can help you find the best available options.

Should I choose term or whole life insurance at age 50?

The choice between term and whole life insurance depends on your specific needs and financial situation. Term life is typically better if you need affordable coverage for a specific period (like until retirement) and have a limited budget. Whole life makes more sense if you want lifetime coverage, are interested in the cash value component for legacy planning, or have a permanent dependent (like a special needs child). Many people in their 50s find that a combination approach works best—using term insurance for temporary needs and a smaller whole life policy for permanent coverage.

How long should my term life policy last if I’m 52?

For a 52-year-old, a 15-20 year term often provides the best balance of coverage and affordability. This would provide protection until age 67-72, covering most people through retirement. Consider your specific situation: when your mortgage will be paid off, when dependents will be financially independent, and your planned retirement age. If you expect to need coverage beyond age 70, you might want to consider a permanent policy or a term policy with strong conversion options, as obtaining new coverage after 70 becomes significantly more expensive and difficult.

Ready to Find Your Perfect Policy?

Compare personalized quotes from top-rated insurers specializing in coverage for people aged 50-59.

,000-1,500 monthly for the same coverage amount. Factors like your health, smoking status, and the specific insurance company can cause these rates to vary considerably. Shorter term lengths (10-15 years) would reduce these premiums substantially.

What health conditions make it difficult to get life insurance in your 50s?

While many health conditions can be accommodated with higher premiums, some make obtaining traditional coverage more challenging. These include recent cancer diagnoses, severe heart conditions, uncontrolled diabetes with complications, chronic kidney disease, and neurological conditions like Parkinson’s disease. However, even with these conditions, options like guaranteed issue policies are available, though with limited coverage amounts. Working with an independent agent who specializes in high-risk cases can help you find the best available options.

Should I choose term or whole life insurance at age 50?

The choice between term and whole life insurance depends on your specific needs and financial situation. Term life is typically better if you need affordable coverage for a specific period (like until retirement) and have a limited budget. Whole life makes more sense if you want lifetime coverage, are interested in the cash value component for legacy planning, or have a permanent dependent (like a special needs child). Many people in their 50s find that a combination approach works best—using term insurance for temporary needs and a smaller whole life policy for permanent coverage.

How long should my term life policy last if I’m 52?

For a 52-year-old, a 15-20 year term often provides the best balance of coverage and affordability. This would provide protection until age 67-72, covering most people through retirement. Consider your specific situation: when your mortgage will be paid off, when dependents will be financially independent, and your planned retirement age. If you expect to need coverage beyond age 70, you might want to consider a permanent policy or a term policy with strong conversion options, as obtaining new coverage after 70 becomes significantly more expensive and difficult.

Ready to Find Your Perfect Policy?

Compare personalized quotes from top-rated insurers specializing in coverage for people aged 50-59.

Securing Your Family’s Future with the Right Life Insurance

Finding the right life insurance for people 50-59 years old involves balancing coverage needs, budget constraints, and health considerations. While premiums are higher than they would have been in your younger years, affordable options are still available with the right approach.

Remember that life insurance serves multiple purposes at this stage of life—from protecting your spouse’s financial future to covering final expenses and leaving a legacy. By understanding the various policy types, comparing quotes from multiple insurers, and working with knowledgeable professionals, you can find coverage that provides peace of mind without breaking your budget.

Take the time to assess your specific needs, explore your options, and secure the protection that will ensure your loved ones are taken care of, regardless of what the future holds. The best time to act is now, as rates will only increase with age and any changes in health status.